Whether you're a global enterprise or a growing business, we have the right trade credit solution for you.

Enterprise Credit Management

Comprehensive trade credit solutions for large organizations with complex global operations and high transaction volumes.

Administrator access control

Global risk assessment

Custom decisioning policies

Enterprise integrations

Mid-Market Solutions

Scalable credit management tools designed for growing businesses looking to optimize their credit operations.

Multi-entity credit management

Automated credit workflows

Branded customer portal

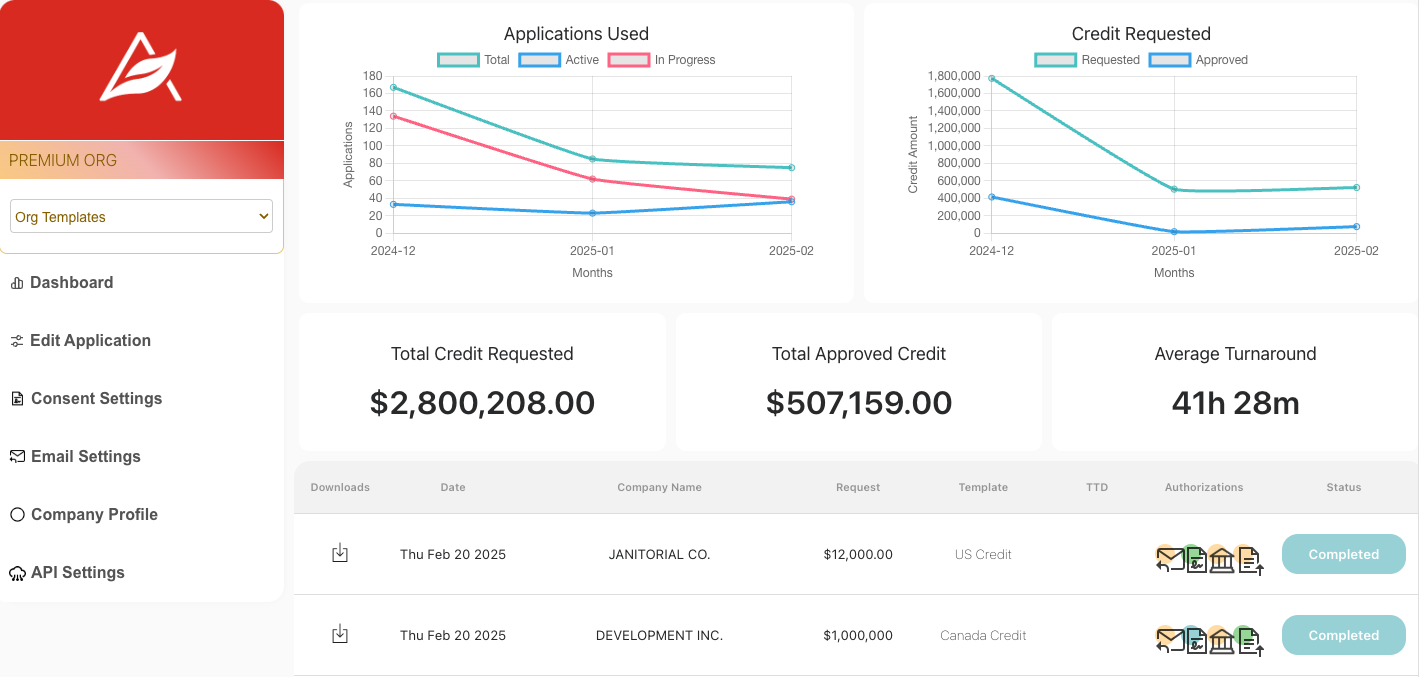

Performance analytics

Credit API Platform

Powerful APIs that enable developers to integrate credit decisioning capabilities into their existing systems.

Real-time credit decisions

Flexible integration options

Customizable risk models

No-code platform support

Transparency Where It Counts, Security Where It Matters

Collaborative credit applications that empower admins and keep customers happy.

Build or Optimize – Power Your Process with Ease

Our API and No-Code support deliver the reliability and versatility you need to accelerate innovation and achieve exceptional results.

Gather the Right Data, the Right Way

Identify key customer insights, optimize collection methods, and enforce precise input controls for accuracy and consistency.

Streamline Credit Decisions with Precision

Align workflows with your credit policy, automate approvals, and triage applications in real-time for effortless, accurate decision-making.

Real-Time Data from 9,000+ Trusted Sources

Creditsafe updates up to 5 million times daily for the most reliable insights.

Seamless & Secure Banking Integration

Connect directly with your clients' financial institutions for a smooth and efficient experience.

Onboard Faster. Grow Smarter

Leverage better data and a seamless credit process to onboard more clients and accelerate sales.

Before Harbr

After Harbr

Cost Savings

Up to 2 months to process paper/PDF applications, and verify trade and bank references.

Flexible credit application with instant credit data, banking insights, and automated trade references.

Revenue Recognition

Delayed financial data, manual cash flow and revenue verification, and unreliable account ownership and fraud detection.

Faster fulfillment, maximize revenue potential with increased limits. Access financial health instantly, automate verification of cash flow, revenue, and payment history.

Improved Collaboration

Insecure application data, no visibility into application status.

Real-time status updates, notifications, administrator access controlled collaboration and data redaction.

Ready to transform your credit operations?

Schedule a personalized demo today.

Application Data

Application Data

Workflow Conditions

Workflow Conditions

Decisioning

Decisioning

Automation

Automation

Why settle for rigid credit applications? Our fully customizable platform puts you in control, allowing you to design credit applications that fit your exact needs. Choose to integrate automated decisioning, real-time financial data, and custom approval workflows—or keep it simple.

With flexible configurations and powerful admin controls, you decide how your process works, ensuring a seamless experience for both your team and your customers.

Ready to transform your credit operations?

Schedule a personalized demo today.